You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boeing 787 Dreamliner

- Thread starter Sundog

- Start date

- Joined

- 3 June 2011

- Messages

- 17,332

- Reaction score

- 9,067

Well that was helpful. Maybe you should call up Boeing and show 'em how it's done.flanker said:The design is plagued because it was designed by drunk monkeys, that is why. Batteries/cells themself are perfectly fine if one doesn't design stupid modules.

blackkite

Don't laugh, don't cry, don't even curse, but.....

- Joined

- 31 May 2007

- Messages

- 8,298

- Reaction score

- 5,910

Oh new knowledge? Dangerous in winter? This battery need air conditioning same as cabin?

It may be unavoidable to say that the environmental test of the battery was insufficient.

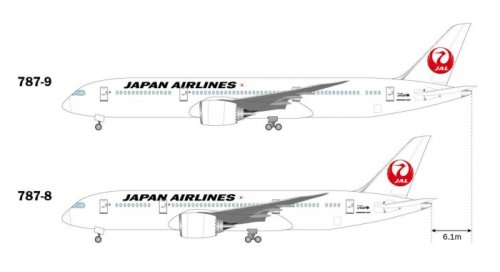

787-9

http://mainichi.jp/graph/2014/08/04/20140804k0000e040150000c/001.html

It may be unavoidable to say that the environmental test of the battery was insufficient.

787-9

http://mainichi.jp/graph/2014/08/04/20140804k0000e040150000c/001.html

Attachments

blackkite

Don't laugh, don't cry, don't even curse, but.....

- Joined

- 31 May 2007

- Messages

- 8,298

- Reaction score

- 5,910

;Dflanker said:The design is plagued because it was designed by drunk monkeys, that is why. Batteries/cells themself are perfectly fine if one doesn't design stupid modules.

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

;D

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

http://ajw.asahi.com/article/business/AJ201409130031

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

This could be relevant: http://www.theregister.co.uk/2014/09/15/fast_charge_might_not_be_death_to_lithium_batteries_say_boffins/

flanker

ACCESS: Top Secret

- Joined

- 20 March 2008

- Messages

- 933

- Reaction score

- 240

Not really. The modules were just designed really really dumb, didnt have anything to do with fast charging. Batteries can handle that with no issues.Grey Havoc said:

Boeing 7E7 concept model manufactured by Flight Miniatures found on eBay.

Source:

http://www.ebay.com/itm/Boeing-7E7-Concept-787-Airplane-1-200-Flight-Minitures-not-Pacmin-2004-release-/221611603704?pt=LH_DefaultDomain_0&hash=item339914b6f8

Source:

http://www.ebay.com/itm/Boeing-7E7-Concept-787-Airplane-1-200-Flight-Minitures-not-Pacmin-2004-release-/221611603704?pt=LH_DefaultDomain_0&hash=item339914b6f8

Attachments

Flight Miniatures manufactures models sold in the Boeing Store.

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

https://ca.news.yahoo.com/this--flying-mega-yacht--may-be-the-nicest-plane-ever-223107114.html

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

malipa said:That is a racist joke! Rather cheap....

Doubt it, especially since blackkite is one of our Japanese members.

While the Dreamliner batteries were/are made by a Japanese company, the ones in question were not made in Japan. Which is what I suspect blackkite was alluding to with his joke.

On another Dreamliner related issue: http://aviationweek.com/advanced-machines-aerospace-manufacturing/opinion-boeing-should-not-lean-labor-cover-787-losses

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

http://phys.org/news/2015-05-faa-airworthiness-issued-power-loss.html

- Joined

- 3 June 2011

- Messages

- 17,332

- Reaction score

- 9,067

^-----(I'd love to see the logistics behind some of those shots.  )

)

https://www.youtube.com/watch?v=vzr313wSY_Y

First time I saw this I wondered if I was about to see a crash. Somebody must have seen that F-22 takeoff and though, "hmmm. . .I wonder. . ." ;D

https://www.youtube.com/watch?v=vzr313wSY_Y

First time I saw this I wondered if I was about to see a crash. Somebody must have seen that F-22 takeoff and though, "hmmm. . .I wonder. . ." ;D

Machdiamond

ACCESS: Secret

- Joined

- 15 January 2007

- Messages

- 325

- Reaction score

- 23

When you see this famous photo of a fully loaded 747 departing Los Angeles on Airliners.net : http://www.airliners.net/photo/0640853/, it becomes clear that proper camera position and long focal length greatly increases the apparent climb angle in a shot like this.

The climb angle in the demo flight is actually about 30 degrees - that's what it was at Farnborough last year anyway. Still impressive though.

--Luc

The climb angle in the demo flight is actually about 30 degrees - that's what it was at Farnborough last year anyway. Still impressive though.

--Luc

- Joined

- 3 June 2011

- Messages

- 17,332

- Reaction score

- 9,067

Machdiamond said:When you see this famous photo of a fully loaded 747 departing Los Angeles on Airliners.net : http://www.airliners.net/photo/0640853/, it becomes clear that proper camera position and long focal length greatly increases the apparent climb angle in a shot like this.

The climb angle in the demo flight is actually about 30 degrees - that's what it was at Farnborough last year anyway. Still impressive though.

--Luc

Yeah, I'm pretty sure we're all familiar with how camera angles work. Those climbs by the 787 are still pretty interesting.

sferrin said:Machdiamond said:When you see this famous photo of a fully loaded 747 departing Los Angeles on Airliners.net : http://www.airliners.net/photo/0640853/, it becomes clear that proper camera position and long focal length greatly increases the apparent climb angle in a shot like this.

The climb angle in the demo flight is actually about 30 degrees - that's what it was at Farnborough last year anyway. Still impressive though.

--Luc

Yeah, I'm pretty sure we're all familiar with how camera angles work. Those climbs by the 787 are still pretty interesting.

Agreed, but I wonder if the 787 outclimbs a 757 with Rolls?

https://www.youtube.com/watch?v=eRiCHgQnf9s

- Joined

- 18 June 2009

- Messages

- 1,290

- Reaction score

- 2,102

I would have liked to have seen the camera rig and a view of the camera aircraft as it climbed in formation ahead of the 787 on its climb out from takeoff in the 2015 practice video.

Watch for the camera ships in this video: https://www.youtube.com/watch?v=AZJtE9Q8WFU

Watch for the camera ships in this video: https://www.youtube.com/watch?v=AZJtE9Q8WFU

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

http://www.flightglobal.com/news/articles/paris-aeroflot-cancels-787-order-413714/

marauder2048

"I should really just relax"

- Joined

- 19 November 2013

- Messages

- 3,157

- Reaction score

- 776

Grey Havoc said:http://www.flightglobal.com/news/articles/paris-aeroflot-cancels-787-order-413714/

Are you tabulating the orders as well?

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

marauder2048 said:Grey Havoc said:http://www.flightglobal.com/news/articles/paris-aeroflot-cancels-787-order-413714/

Are you tabulating the orders as well?

Not really. The Aeroflot cancellation is likely fallout from the ongoing sanctions and associated political turmoil. However I thought it worth a mention in light of claims that UAC is working on it's own entry into the 787's niche.

- Joined

- 9 October 2009

- Messages

- 19,942

- Reaction score

- 10,450

http://www.flightglobal.com/news/articles/pictures-boeing-donates-first-787-to-nagoya-airport-414356/

"Boeing looks at pricey titanium in bid to stem 787 losses"

Reuters By Alwyn Scott

July 24, 2015 11:12 AM

Source:

http://finance.yahoo.com/news/boeing-looks-pricey-titanium-bid-stem-787-losses-142611083.html

Reuters By Alwyn Scott

July 24, 2015 11:12 AM

Source:

http://finance.yahoo.com/news/boeing-looks-pricey-titanium-bid-stem-787-losses-142611083.html

SEATTLE (Reuters) - Boeing Co <BA.N>, which loses about $23 million on every 787 Dreamliner passenger jet that leaves the factory, is trying to stem the losses by cutting the use of one of its signature ingredients: titanium.

The strong, lightweight alloy used extensively on the 787 costs seven times more than aluminum, and accounts for about $17 million of the cost of the $260 million plane, according to industry sources.

The push to reduce titanium costs is part of a broader, long-running effort by Boeing to make the 787 profitable that includes pressing suppliers for price cuts and adjusting assembly lines to improve efficiency, said Bob Noble, vice president of Partnering for Success, Boeing's supplier cost-cutting program.

Boeing's other commercial planes are profitable, and on Wednesday, Boeing repeated its pledge to break even on the 787 this year on a cash basis. With titanium making up 15 percent of the 259,000 pounds an empty 787 weighs, far more than other Boeing jetliners, the material is under special scrutiny, industry experts said.

The world's largest plane maker hasn't disclosed how many billions it invested to develop the 787, which was introduced in 2011, but it has spent more than $30 billion on production, tooling and one-time costs. And it has curbed its ambitions for future planes. Former chief executive Jim McNerney said last year Boeing didn't plan any more "moonshots" like the 787.

As the Chicago-based company races to increase the pace of plane manufacturing, investors and analysts want it to lift its profits by churning out more 787s while cutting costs.

"Aerospace titanium at $20 to $25 a pound is front and center, especially when you have the cost problems that you do on the 787," said Kevin Michaels, a vice president with ICF International, a publicly traded management, technology and policy consulting firm based in Fairfax, Virginia.

787 COSTS RISE

Commercial jetliner programs typically lose money in the early years of production until the heavy upfront investments in engineering and production are repaid. Boeing's accounting spreads those costs over a large block of planes the company expects to deliver.

Investors expressed concern in April when the 787's deferred production cost balance reached $26.9 billion, about $2 billion more than earlier targets. The tally is a gauge of the losses Boeing has built up making 787s so far.

Boeing said the 787 deferred cost balance will keep rising until 2016, when the company plans to begin turning out 12 of the planes a month, up from 10 currently. At that point, Boeing expects the balance will start decreasing.

Overall, Boeing said it earns a operating profit margin of 10.5 per cent in its commercial jetliner business, including sales of planes and related services.

The 787 represents Boeing's bid to reinvent the civilian jetliner, using lightweight carbon fiber and new engines to allow it fly farther and burn 20 percent less fuel than current jets made largely of aluminum. Unlike aluminum, which corrodes when it comes into contact with carbon fiber, titanium works well with carbon fiber and expands minimally in response to the large temperature swings the big jets experience.

But the 787 now faces dual competition from Airbus: its own carbon-composite plane, the A350, and a low-cost alternative, the A330neo, based on an older aluminum design updated with new, fuel-efficient engines.

Those are likely to keep price pressure on both plane makers, "especially in a low oil price environment," said Russell Solomon, aerospace analyst at Moody's Investor Service.

While the rising level of deferred costs affects the 787's ultimate profitability, Solomon said, "it's the ongoing cost that we're really paying attention to."

As part of its cost-reduction effort, Boeing considered shifting to less costly aluminum for seat tracks on the 787, industry sources say. Boeing said it didn't end up making the change, but declined to say why.

Boeing has changed the cockpit window frame to aluminum from titanium, and has changed the frames of some doors to composite from titanium. Special coatings or materials are used to prevent aluminum corrosion, experts said. It wasn't known how much Boeing saved by the change. Boeing declined to comment.

Boeing said it also is "aggressively pursuing" recycling to recapture the waste metal "chips" created as titanium parts are machined into finished shapes.

BUYING 40 POUNDS TO GET 1

The company is looking for even greater savings in its supply chain and production methods. The changes are not likely to affect raw metal prices, but could reduce the sales of some suppliers, and stem concern about supply constraints from Russia, experts said.

One large 787 piece, used to help join the wings to the body, shows the potential for saving. The piece, known as the double plus chord, requires Boeing to buy about 40 pounds of titanium for every pound that ends up flying on the aircraft, said Bill Bihlman, president of metal consultancy Aerolytics LLC.

After the piece is forged, a large amount of the outside must be ground off, leaving interior metal with intact grain and strength. Add in the high cost of machining hard metals like titanium, and the value of such pieces soars.

"You can see why there's so much emphasis on titanium," Bihlman said.

Noble, the Boeing official, declined to discuss specific parts, but said pieces with high "buy-to-fly" ratios are a focus.

"There are a whole lot of strategies we can use to reduce the buy-to-fly," he said.

But substituting other metals won't be easy, Bihlman said. Steel weighs 65 percent more than titanium, and aluminum lacks titanium's strength and has the corrosion problem.

But even though the titanium savings may ultimately be modest, Bihlman said, Boeing will wring them out "because they have to."

(Reporting by Alwyn Scott, editing by Joe White and John Pickering)

- Joined

- 2 August 2006

- Messages

- 3,174

- Reaction score

- 1,155

Looks to me like Boeing needs to scale up 3D printing (Additive Manufacturing) for the large titanium parts. Of course, that would be a win for the entire aerospace industry if they figure that out.

Steve Pace

Aviation History Writer

- Joined

- 6 January 2013

- Messages

- 2,266

- Reaction score

- 167

Somehow I just don't believe that Boeing is losing $23 million per airplane. I just can't rap my head around that. Businesses produce products to make money, not lose money. There's nearly 1,000 787s on order - multiply 23 million times that and the loses are nothing less than astronomical. So if this is true Boeing's stock holders should be more than just a little pissed off! -SP

Sundog said:Looks to me like Boeing needs to scale up 3D printing (Additive Manufacturing) for the large titanium parts. Of course, that would be a win for the entire aerospace industry if they figure that out.

Already a lot of work happening there...

"Will Boeing's Troubled 787 Dreamliner Finally Pay Off?"

February 11, 2015

Source:

http://www.fool.com/investing/general/2015/02/11/will-boeings-troubled-787-dreamliner-finally-pay-o.aspx

February 11, 2015

Source:

http://www.fool.com/investing/general/2015/02/11/will-boeings-troubled-787-dreamliner-finally-pay-o.aspx

Touching breakeven... finally

Boeing hopes to be cash positive on the 787 program later in 2015, which means the company would be able to match the incremental costs to build a 787 with the unit selling price of the plane. At the fourth-quarter earnings call in January, Boeing CFO Greg Smith noted that the unit cost of the 787-8 and 787-9 have fallen 30% and 20% since the initial delivery.

Cash breakeven doesn't mean the program becomes profitable as a whole. It's going to take a while before actual revenue earned on the program exceeds the total costs incurred. As reported by Reuters, Richard Aboulafia of the Teal Group calculated that each 787 is selling at an approximate loss of $30 million, based on the third-quarter 2014 deferred cost of $25.2 billion. Deferred cost represents the difference between Boeing's actual cost to build each 787 and the average projected cost per unit for the initial 1,300 units.

However, Boeing is able to avoid recording actual losses on the Dreamliner program as it uses the program accounting method, under which it records profits by booking the average cost of the aircraft taken over the entire program period instead of the actual cost. Had Boeing booked the actual cost, it would have registered a loss of $122 million in the commercial airplane division instead of a pre-tax profit of $6.4 billion in 2014.

More than a year's wait before deferred costs decline

While investors are eagerly waiting for the 787's cash breakeven, it's coming at the cost of huge investments in productivity enhancements that have pushed up the deferred cost on the program.

Boeing had forecast that Dreamliner's deferred cost would rise to a maximum $25 billion before the company begins digging itself out of the hole in 2015. However, the deferred cost for the program surpassed the $25 billion mark in the third quarter of 2014, and finally piled up to $26.1 billion at the end of 2014.

Apart from spending on streamlining the process to enhance the program's productivity, Smith acknowledged that delay in contract renegotiation with suppliers and labor for the 787-9 Dreamliner cost the company more than expected. According to Flightglobal, Boeing is likely to spend another $2.5 billion over the next nine months, pushing up deferred costs to over $30 billion before the Dreamliner program attains cash breakeven.

According to Boeing's estimates, investors will have to wait till the company increases its production rate to 12 a month in 2016 before deferred costs start declining. Fortunately, the company has adequate backlogs to support the higher 787 production levels over the coming years. It had 836 pending orders for the 787 at the end of January, which means nearly seven years of work at the current production rate of 10 a month.

Investors wait for the cash boost

Boeing's erratic cash generation has troubled investors for some time. Despite record deliveries in the commercial aviation segment, the company's cash flow generation has dwindled. The Dreamliner had a big role to play in this, as Boeing is bleeding cash on each sale. Once that stops later in the year, and the program slowly starts contributing toward cash flows, we could see a better reflection of the soaring deliveries on cash flow numbers.

For 2015, Boeing has predicted cash flow of $6.2 billion, which, according to Reuters, is at the higher end of analysts' expectations. In 2014, Boeing generated $4.3 billion cash flows. JPMorgan analyst Joseph Nadol noted that "solid 2015 cash flow guidance suggests confidence on lower 787 unit costs." The situation could improve further once the deferred costs start leveling off in 2016.

For years, Boeing has invested in the troubled 787 program in hopes of turning it around. Finally, the company's efforts could begin bearing fruit as unit costs on producing the Dreamliner come down. The cash breakeven is definitely a big milestone, which could be followed by the burn off of deferred costs from 2016. When that happens, the 787 program will show profits not just in Boeing's books of accounts, but in actual terms, too.

- Joined

- 3 June 2011

- Messages

- 17,332

- Reaction score

- 9,067

Sundog said:Looks to me like Boeing needs to scale up 3D printing (Additive Manufacturing) for the large titanium parts. Of course, that would be a win for the entire aerospace industry if they figure that out.

I'm still skeptical that a 3D printed part can be as strong and light as a machined forging. Then again maybe there's a way they can use the printing technology to their advantage and remove material from the inside of the part.

- Joined

- 21 April 2009

- Messages

- 13,168

- Reaction score

- 6,051

Originally posted over at the Next Generation Bomber thread probably applicable here as well:

http://aviationweek.com/defense/under-radar-project-aims-slash-boeing-costs?NL=AW-19&Issue=AW-19_20150716_AW-19_223&sfvc4enews=42&cl=article_1&utm_rid=CPEN1000000230026&utm_campaign=3186&utm_medium=email&elq2=4327e65b3c014cafa3b83e06adbe9e16

Boeing believes a closely held manufacturing technology initiative, code-named Black Diamond, will give it a competitive edge in the Long-Range Strike Bomber (LRS-B) and T-X trainer contests and also reduce the costs of future commercial airplane programs, according to outside analysts who have been briefed on it. The effort is led by the Phantom Works unit of Boeing’s Defense, Space & Security division, which is believed to be building a large-scale demonstrator airframe to prove and showcase key technologies.

Black Diamond, one analyst says, is closely linked to new CEO Dennis Muilenburg. “It’s one reason why he’s the next CEO,” that source says. Boeing declined comment on the initiative.

Black Diamond is company-funded and free from government security regulations, which has allowed the company to involve its commercial aircraft unit and its outside partners. Its goal is to advance the state of the art in two related disciplines: engineering based on detailed computer models that include all the physical properties of each part, not just its shape, and robotic fabrication and assembly

http://aviationweek.com/defense/under-radar-project-aims-slash-boeing-costs?NL=AW-19&Issue=AW-19_20150716_AW-19_223&sfvc4enews=42&cl=article_1&utm_rid=CPEN1000000230026&utm_campaign=3186&utm_medium=email&elq2=4327e65b3c014cafa3b83e06adbe9e16

Boeing believes a closely held manufacturing technology initiative, code-named Black Diamond, will give it a competitive edge in the Long-Range Strike Bomber (LRS-B) and T-X trainer contests and also reduce the costs of future commercial airplane programs, according to outside analysts who have been briefed on it. The effort is led by the Phantom Works unit of Boeing’s Defense, Space & Security division, which is believed to be building a large-scale demonstrator airframe to prove and showcase key technologies.

Black Diamond, one analyst says, is closely linked to new CEO Dennis Muilenburg. “It’s one reason why he’s the next CEO,” that source says. Boeing declined comment on the initiative.

Black Diamond is company-funded and free from government security regulations, which has allowed the company to involve its commercial aircraft unit and its outside partners. Its goal is to advance the state of the art in two related disciplines: engineering based on detailed computer models that include all the physical properties of each part, not just its shape, and robotic fabrication and assembly