You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exxon profits surge despite $3.4B hit from Russian exit

- Thread starter edwest4

- Start date

The Energy Sector will always be lucrative.

Musk notwithstanding, you can only make so much money on comsats.

Space Solar Power is a way for aerospace to tap those profits directly...as opposed to just warfighting that folks are sick of.

Powersats don't chop up birds or burn them. They keep Greens happy and don't enrich warmongers like Cheney.

In the past oil wars, big aerospace and big oil were on the same side.

Space solar power can now drive a wedge between these two interest groups.

Now if Dwayne would kindly keep to his Cold War marginalia and quit his sabotage attempts in the pages of Space Review...

One other thing to consider:

Dyson Harrop cable based Space solar power sats may exist only as cables...not as much in the way of surface area...perhaps also lending itself towards ASTEN like Superconducting magnetic energy storage (SMES) systems.

https://en.wikipedia.org/wiki/Dyson–Harrop_satellite

---and maybe even defense against solar kill-shots:

We outline a mitigation strategy to protect our planet by setting up a magnetic shield to deflect charged particles at the Lagrange point L1, and demonstrate that this approach appears to be realizable in terms of its basic physical parameters.

Tethers have been looked at to siphon off the Van Allen Belts...

Now we have one way superconductivity:

phys.org

phys.org

More useful for computing now....but maybe scaled up later for a return to direct current...and Edison's re-ascendancy?

Musk notwithstanding, you can only make so much money on comsats.

Space Solar Power is a way for aerospace to tap those profits directly...as opposed to just warfighting that folks are sick of.

Powersats don't chop up birds or burn them. They keep Greens happy and don't enrich warmongers like Cheney.

In the past oil wars, big aerospace and big oil were on the same side.

Space solar power can now drive a wedge between these two interest groups.

Now if Dwayne would kindly keep to his Cold War marginalia and quit his sabotage attempts in the pages of Space Review...

One other thing to consider:

Dyson Harrop cable based Space solar power sats may exist only as cables...not as much in the way of surface area...perhaps also lending itself towards ASTEN like Superconducting magnetic energy storage (SMES) systems.

https://en.wikipedia.org/wiki/Dyson–Harrop_satellite

---and maybe even defense against solar kill-shots:

We outline a mitigation strategy to protect our planet by setting up a magnetic shield to deflect charged particles at the Lagrange point L1, and demonstrate that this approach appears to be realizable in terms of its basic physical parameters.

Tethers have been looked at to siphon off the Van Allen Belts...

Now we have one way superconductivity:

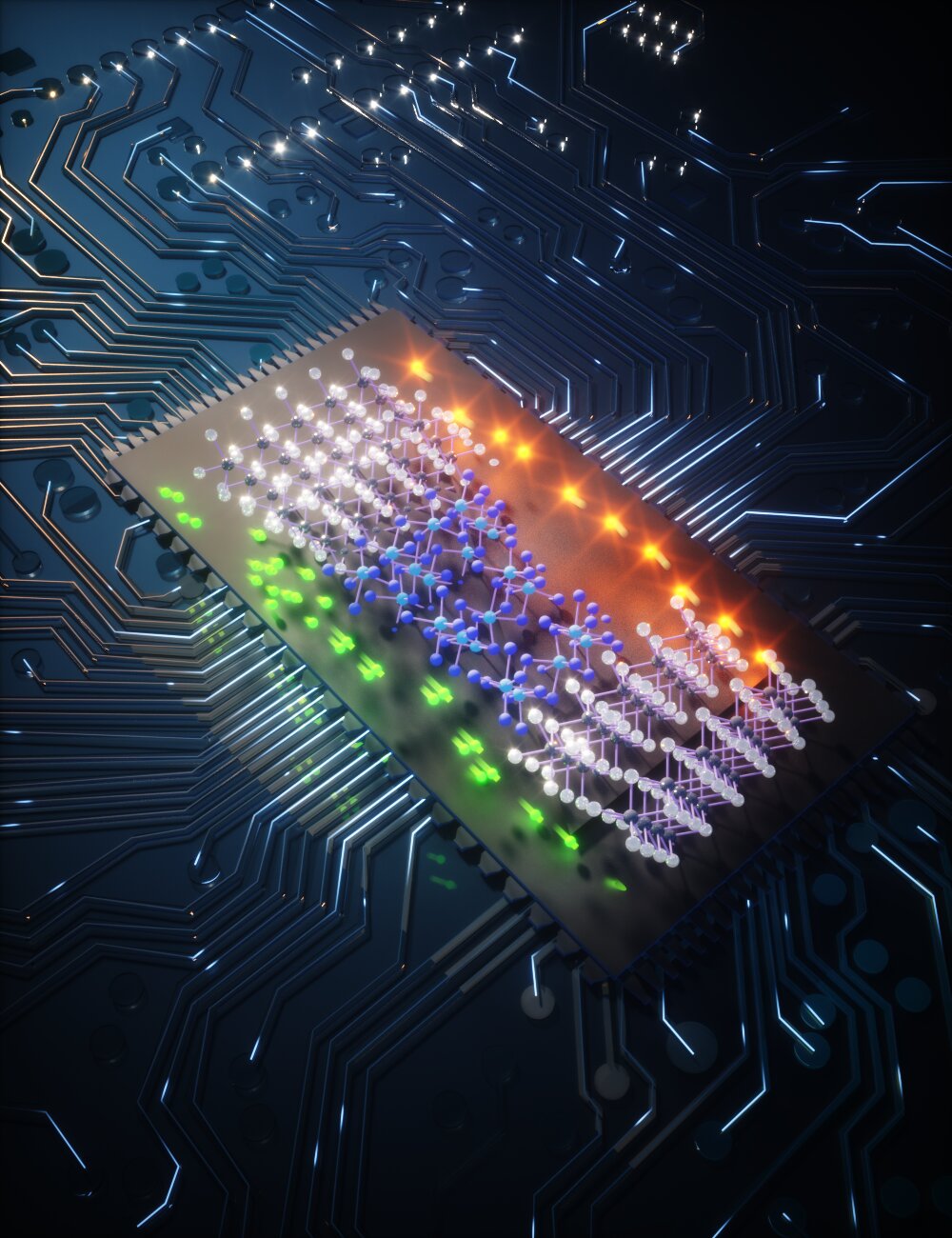

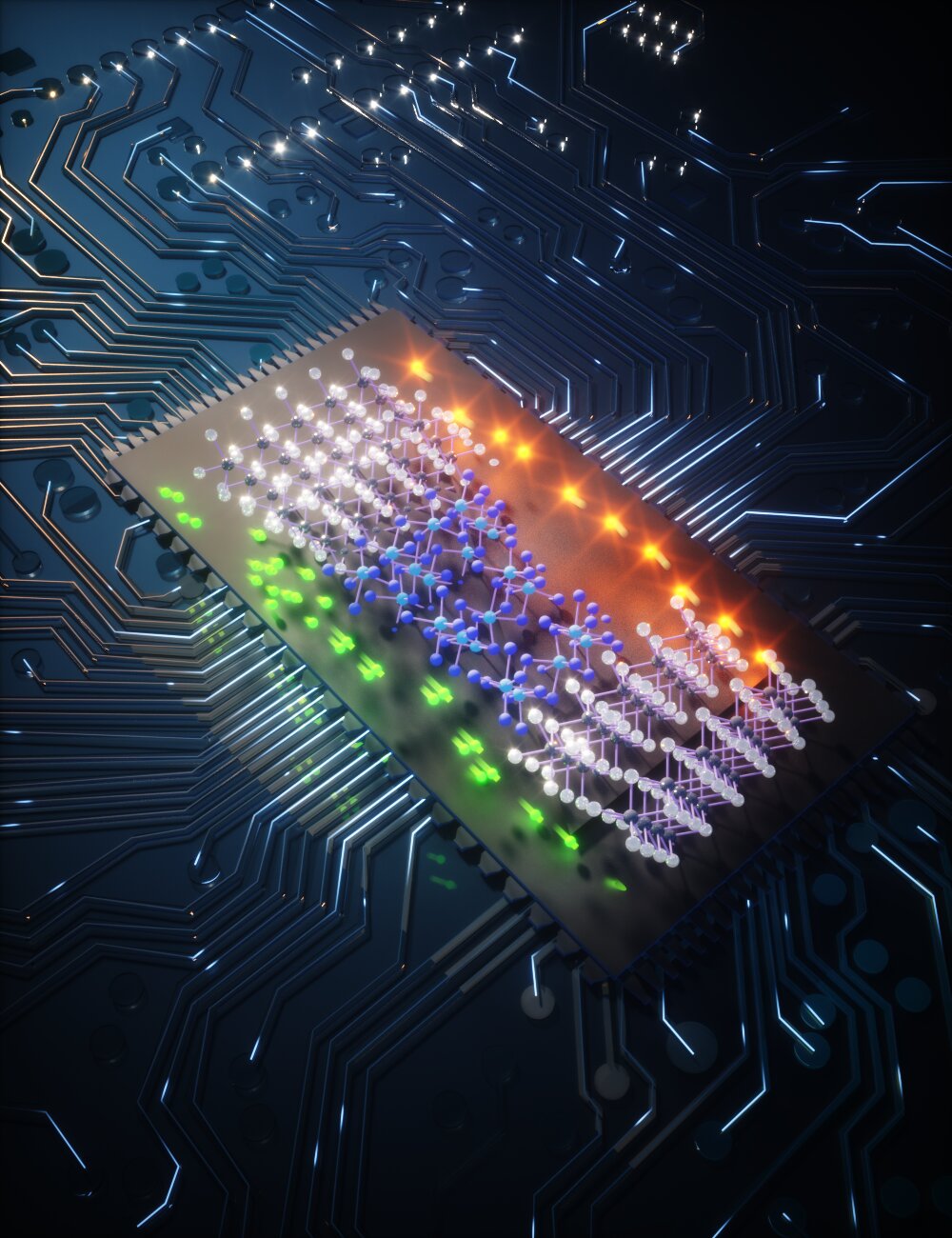

Discovery of the one-way superconductor, thought to be impossible

Associate professor Mazhar Ali and his research group at TU Delft have discovered one-way superconductivity without magnetic fields, something that was thought to be impossible ever since its discovery in 1911—up until now. The discovery, published in Nature, makes use of 2D quantum materials...

More useful for computing now....but maybe scaled up later for a return to direct current...and Edison's re-ascendancy?

Last edited:

- Joined

- 3 January 2006

- Messages

- 977

- Reaction score

- 422

When a company both extracts and refines oil, like Exxon, oil prices can be a mixed blessing. Falling oil prices can actually increase refinery profit margins, while hitting the extraction business. I can only suppose that Exxon benefits most from moderately high oil prices, not extremely high oil prices because of their refinery bussiness. It’s also worth noting that no entirely new oil refinery has been approved by the EPA in decades. In America, every oil refinery is essentially grandfathered in, and while individual refinery capacity can be increased, the overall number of refineries never will. So, it’s good to own oil refineries, maybe better than owning oil wells. Until they ban all hydrocarbons in another 15 or 20 years.OK, I just lost $3.4 Billion and still made a profit. Something's wrong with the math here. No link due to the lack of logic.

A bit of missing context, the $5.48 B profit on a topline of $90.5 B is a 6% margin, not that good, especially when the last quarter was over 10% on almost $83 B. Which helps explain why that obscene profit reported caused the share price to tumble almost 5%, Further, the $3.4 B write down isn't exactly an operating loss, more of a one time accounting thing.

The first tech company I could pull up a quarterly for had a 20% margin, but everyone seems to not complain about that obscene profit, if only because it was on a $5 B topline. But I digress.

The first tech company I could pull up a quarterly for had a 20% margin, but everyone seems to not complain about that obscene profit, if only because it was on a $5 B topline. But I digress.

- Joined

- 25 July 2007

- Messages

- 3,876

- Reaction score

- 3,190

There's a bit of a difference between a declared force majeure and an operating loss.

Interesting. In my limited understanding, force majeure is a result of 'unforeseeable' events. So how does that apply in the case of the Exxon pull-out and closing of Sakhalin-1?

Would this be considered force majeure because the 'special operation' against Ukraine was 'unforeseeable'?

Or because Western sanctions against Russia including the oil-and-gas sector were 'unforeseeable' to Exxon?

Just curious.

It's because at the time of the investment decision the act was unforeseen. My own employer declared force majeure in 2014 on an investment in Ukraine and will no doubt do the same for the assets in Russia we walked away from this year. The decision gate(s) on a lot of this stuff was pre-2008, post 2014 likely little if any additional capital beyond what was already pledged got added purely because of the NTR of what happens if...There's a bit of a difference between a declared force majeure and an operating loss.

Interesting. In my limited understanding, force majeure is a result of 'unforeseeable' events. So how does that apply in the case of the Exxon pull-out and closing of Sakhalin-1?

Would this be considered force majeure because the 'special operation' against Ukraine was 'unforeseeable'?

Or because Western sanctions against Russia including the oil-and-gas sector were 'unforeseeable' to Exxon?

Just curious.

Last edited:

Similar threads

-

-

-

Top secret UK military system is still managed by scandal-hit Fujitsu

- Started by Flyaway

- Replies: 3

-

The second launch from Russia’s new spaceport has failed

- Started by Flyaway

- Replies: 5

-