EADS, BAE Systems in Advanced Merger Talks

By Reuters Staff

September 12, 2012

http://www.aviationweek.com/Article.aspx?id=/article-xml/awx_09_12_2012_p0-494691.xml

By Reuters Staff

September 12, 2012

http://www.aviationweek.com/Article.aspx?id=/article-xml/awx_09_12_2012_p0-494691.xml

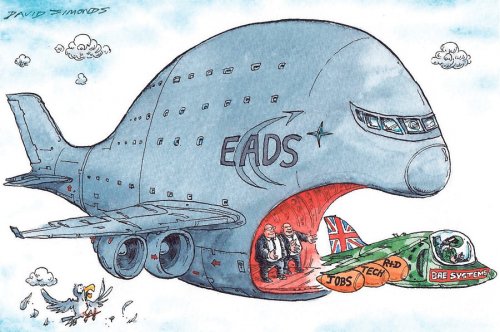

Europe’s EADS, the parent of Airbus, and Britain’s BAE Systems are in advanced discussions about a merger, two sources close to the deal said Sept. 12.

BAE shareholders would own 40 percent of the combined group and EADS shareholders the remaining 60 pct, BAE said in a statement.

“The potential combination would create a world class international aerospace, defence and security group with substantial centers of manufacturing and technology excellence in France, Germany, Spain, the U.K. and the U.S.A.,” BAE Systems said.

A merger of the two European aerospace companies would not be expected to raise antitrust concerns in the United States given the modest amount of U.S. military revenues generated by EADS, according to the sources, who were not authorized to speak publicly.

They said a merger has been under discussion for several months, spurred in large part by declining defense spending in Europe and the United States.

The two companies have a long history of collaboration and are partners in a number of projects, including the Eurofighter and a deal would also bring BAE back into having a direct interest in Airbus and its British plants, having sold its 20 percent stake in 2006.

Combined, BAE and EADS would have combined sales of about 72 billion euros, based on 2011 numbers, and would have 220,000 employees worldwide.

The companies said that due to the sensitive nature of the companies’ defence business in countries stretching from the United States to Saudi Arabia and Australia, they were talking to governments around the wrold about the deal.

They said certain defence activities would be ringfenced with governance arrangements appropriate to their strategic and national security importance, particularly in the United States, given the importance of that market to the enlarged group.