- Joined

- 9 October 2009

- Messages

- 19,999

- Reaction score

- 10,513

Oil tanker jam forms off Turkey after start of Russian oil cap (ft.com, subscription or registration may be required)

www.reuters.com

www.reuters.com

www.telegraph.co.uk

www.telegraph.co.uk

A traffic jam of oil tankers has built up in Turkish waters after western powers launched a “price cap” targeting Russian oil and as authorities in Ankara demanded insurers promise that any vessels navigating its straits were fully covered.

Under EU sanctions that came into effect on Monday, tankers loading Russian crude oil are barred from accessing western maritime insurance unless the oil is sold under the G7’s price cap of $60 a barrel. The cap was introduced to keep oil flowing while still crimping Moscow’s revenues.

Four oil industry executives said Turkey had demanded new proof of insurance in light of the price cap. A Turkish transport ministry spokesman did not immediately respond to a request for comment.

Russia has vowed to continue exporting its oil even if it is cut off from western insurance markets. Russia has said it will not deal with any country abiding by the cap.

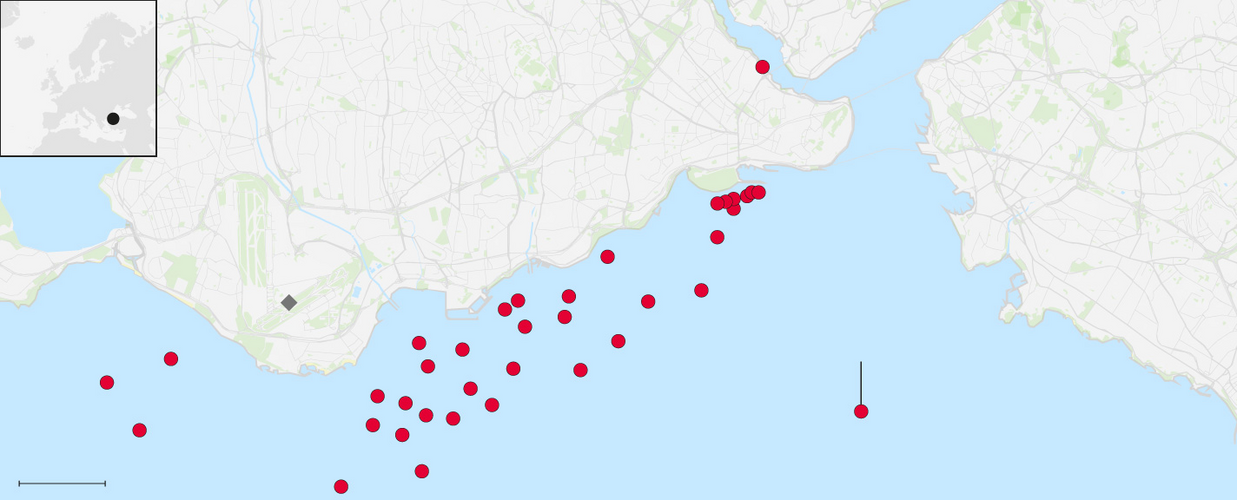

Around 19 crude oil tankers were waiting to cross Turkish waters on Monday, according to ship brokers, oil traders and satellite tracking services. The vessels had dropped anchor near the Bosphorus and Dardanelles, the two straits linking Russia’s Black Sea ports to international markets. The first tanker arrived on November 29 and has been waiting for six days, according to a ship broker who asked not to be named.

The tankers waiting in and around Turkish waters are the first sign that the price cap could disrupt global oil flows beyond Russia’s exports.

[snip]

Oil tankers queue up off Turkey as price cap on Russian crude kicks in - FT

Oil tankers formed a traffic jam off the coast of Turkey on day one of the West's price cap on Russian crude, with Ankara insisting on new proof of insurance for all vessels, the Financial Times reported on Monday.

Oil tanker traffic jam threatens diplomatic row with Turkey

Demands for additional paperwork following Russia price cap leaves oil tankers stuck in Turkish waters