PARIS — Even with jets roaring overhead, the loudest blast in the defense sector during the Paris Air Show came from United Technology Corp.'s acknowledgement that it has multiple bids — at attractive levels — for subsidiary Sikorsky Aircraft, makers of the US Army's Black Hawk helicopter.

Four bidders remain in active discussions with UTC about acquiring Sikorsky: Lockheed Martin, Airbus, Textron and the investment firm Blackstone, according to sources. The deal is expected to be finalized within coming weeks, they said.

Just a few months ago, a spinoff of Sikorsky seemed likely, as UTC indicated it was considering getting out of the helicopter business. UTC officially announced last week that it would divest itself of the $8 billion helicopter producer, either through a sale or spinning it off as a separate corporate entity.

In the meantime, UTC received robust interest in Sikorsky, which also makes the CH-53K, a heavy-lift helo for the US Marine Corps, and the S-92, which can be used for search and rescue and VIP transport, among other platforms.

Officially, most of the potential buyers remain tight-lipped. Through a spokeswoman, Lockheed Chairman, President and CEO Marilyn Hewson declined to comment, as did Textron Systems President and CEO Ellen Lord and a spokesman for Blackstone.

Airbus CEO Tom Enders didn't rule out the possibility of acquiring a US company when asked about Sikorsky.

"We certainly do not exclude to do acquisitions in the US where it makes sense," he told Defense News. "We are one of the premiere helicopter manufacturers in the world, right? So quite obviously, we have a keen interest in what is happening with Sikorsky, because one way or the other, it will influence the industry."

The issue of whether the Pentagon would allow a foreign company to take over as the maker of such a high-profile platform should be decided on a case-by-case basis, not with a blanket rule against foreign ownership, Enders said.

"I don't think it's a theoretical question. That question should be pursued with a concrete case. I don't think to say in general terms, you could do it, or you could not do it, would be appropriate," he said.

Ray Jaworowski, senior aerospace analyst for Forecast International, said Sikorsky was a good fit for the defense firms still believed to be in the running.

"Sikorsky, whether on its own or someone takes it over, has a fairly good business outlook," he said.

If Textron, which owns Bell Helicopter, acquires Sikorsky, the two companies' product lines would dovetail without much overlap, giving Textron a very complete product line to bring to market, he said.

Similarly, Sikorsky's platforms would complement Airbus' helicopter business. But such a union might raise objections from the Pentagon, which may not want the producers of the US Army's iconic Black Hawk to be owned by a foreign company, he said.

Lockheed doesn't own a helicopter business, although they are involved in systems integration on rotary aircraft, he said.

"It would certainly create a one-stop defense company," capable of delivering fighters, transports and special purpose aircraft, Jaworowski said. "There's very little they don't do on the military side."

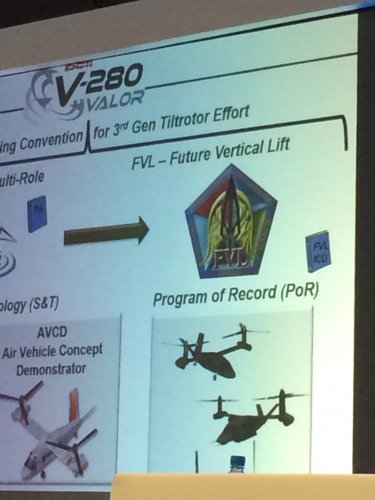

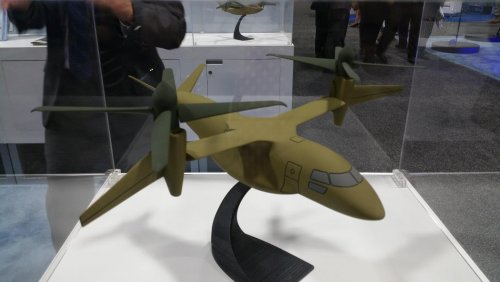

The eventual buyer immediately improves its odds of winning the competition for Future Vertical Lift (FVL), the Pentagon's program to develop the next generation of helos for the US armed forces.

Jaworowski likened the competition to the dogfight for the joint strike fighter competition, which ultimately went to Lockheed Martin and the F-35.

"Whoever wins [FVL] will dominate the market for years to come," he said.

Byron Callan, an analyst with Capital Alpha Partners, said that both Europe and the US will weigh in on the deal from a regulatory standpoint.

Another issue will be how the other major helicopter manufacturers react. An Airbus victory would create the largest helicopter firm in the world, he said, and could bring objections from Bell, Agusta-Westland and Boeing. If Textron succeeds, it would create concern at Boeing, which produces Apache and Chinook helicopters for the US military.

A Lockheed deal shouldn't be a major disruption to this market segment, but would represent a significant departure from their current business strategy, Callan added.

A private equity owner would also make sense, "and would entail essentially the same outcome as a spin-off, but also may bring more discipline to implement significant cost reductions at Sikorsky," he said.

In a broader sense, a potential Sikorsky sale, following the Orbital/ATK and Harris/Exelis mergers, provides further indication that the defense sector is poised for a flurry of merger and acquisition (M&A) activity.

Michael Richter, managing director of Lazard's defense and aerospace investment banking group, called 2015 "one of the strongest years in M&A we've seen at the show in quite some time."

Most firms are looking for tuck-in acquisitions as opposed to transformative deals in the defense arena, he said.

"Companies are actually putting their toe in the water, and receiving very nice valuations," he said.

Lingering uncertainty around the US defense budget means that conventional wisdom has not settled about which way the market is heading, he said. This means potential buyers are still looking for bargains, while high valuations are attracting potential sellers.

"That's a perfect environment for people to invest in, because you can establish an opinion," he said. "We think it really is the start of a wave of consolidation in the defense space."

Pierre Chao, managing partner at Renaissance Strategic Advisors, told Defense News that firms are still sorting out their M&A strategies.

"It was only 18 to 24 months ago there was a great deal of budget uncertainty. There still is some, but I think people are beginning to feel the bottom," he said. "That's allowing people to undertake strategic reviews and assessments and decide what do they consider to be core and non-core."

Chao said he expects to see additional fragmentation of the industry before large amounts of consolidation.

"It's from those fragments we'll get the new repositioning," he said.

Company officials largely demurred when asked to elaborate on their M&A outlooks.

Lockheed's Hewson said the company expected to spend $15 billion over the next three years on dividends to investors and share buybacks.

"But that does not mean that we will not be deploying cash to continue to invest for growth in our business, and capital equipment, and other opportunities that we have with our cash," she said. In some cases, that means joint ventures, or investing in another company, she said. Sometimes, that can mean an acquisition, as it did when Lockheed bought cybersecurity firm Industrial Defender and information processing firm Zeta Associates.

"We take our core competencies, and move into near adjacencies," Hewson said.

Boeing is focused on growing its business organically, said Dennis Muilenburg, the company's vice chairman, president and COO.

"M&A is an important complement, of course, when we see niche gaps that we want to fill, we'll make targeted acquisitions to fill those gaps. But our strategy hasn't changed, it's primarily organic investment" augmented by acquisitions, he said.

Textron Systems' Lord said the company would not likely be sellers.

"We're not looking to divest. We like our businesses, and we're looking to grow," she said.

Phil Jasper, executive vice president and COO of government systems for Rockwell Collins, said the company wasn't leaning one way or the other. The decision to acquire or divest would depend on the opportunity presented.

While the US defense budget is beginning to see a little stability, it has been down over the last few years, he said.

"We have divested properties over that period of time" and focused on keeping costs down, he said.

The further you get away from your core business, the harder it is to fold in a new business, he said.

"Divestitures and acquisitions are always going to be part of that mix," he said. "I'm very happy with the portfolio as we have it now."