Coaxial compound and tiltrotor aircraft are making news thanks to the U.S. Army’s search for the next-generation platform to replace its Sikorsky Black Hawk and Boeing Apache helicopter fleets from 2035 onward.

While both technologies have been around for many years and to differing levels of development, the prospect of winning a contract for between 2,000 and 4,000 U.S. Army helicopters to come into service from the mid-2030s is not something that any rotorcraft company would wish to ignore.

The U.S. Army’s Aviation and Missile Research, Development and Engineering Center (AMRDEC) launched the multi-phase Joint Multi-Role technology demonstrator (JMR TD) program, which is expected to lead eventually to Future Vertical Lift (medium variant).

The declared intent is to down select two of the four companies who are competing by the end of June, and they will go forward to produce a flying technology demonstrator by 2017. There are four competing teams during this first phase (for all the principle players are supported by their own industry teams – some of whom are on more than one team). They are: Boeing/Sikorsky; Bell Helicopter; AVX Aircraft; and Karem Aircraft (about which perhaps the least is known).

The fact that the JMR TD Phase 1 competition has come at a time of sequestration in the United States, as well as an economic downturn in Europe, has resulted in a reassessment by all concerned about how the objective will be reached. The two main European manufacturers, Airbus Helicopters and AgustaWestland, are not competing – at least not at this stage. Airbus’ management continues to stress that the company is pushing forward with its own research after the successful flight of its own technology demonstrator aircraft, the X³ high-speed compound helicopter. Meanwhile, AgustaWestland is modifying what Bell would call its second-generation tiltrotor, the AW609, although there are currently no plans to militarize the aircraft.

While not in the first phase of JMR, it is too early yet to tell if both the European companies will not have a role to play in the eventual development of the FVL (medium) aircraft.

Rather than tackle this challenge independently, Boeing and Sikorsky have teamed up to offer a coaxial compound helicopter based on Sikorsky’s own technology demonstrator, the X2, which flew from August 2008 to July 2011 completing 23 test flights and logging 22 hours airborne. It is not the first time that the two organizations have teamed up over a rotorcraft research project; the RAH-66 Comanche program is well documented.

To do this, Boeing had to move away from its partnership with Bell Helicopter and the V-22 program. Both Boeing and Bell are keen not to make any impression that the V-22 has nothing but a bright future, particularly for foreign military sales (FMS) countries such as those who have already expressed an interest including Israel, Japan, the United Arab Emirates and Qatar among others, any further technical advances could potentially be fed by Bell into its V-280 Valor JMR offering which will directly complete with the Boeing/Sikorsky Defiant.

Recently, Rotor & Wing had the opportunity to talk to the current head of Bell Helicopter, President and CEO John Garrison, who leads the strongest tiltrotor challenge, and AVX Aircraft’s president and chief engineer Troy Gaffey, himself a 38-year Bell veteran but now championing his company’s coaxial compound helicopter (CCH).

Gorilla in the Room

Bell Helicopter has firmly kept to its strength as a champion of the V-22 and continues this technology focus with the launch its third generation V-280 Valor tiltrotor. Garrison describes it, though, as a clean sheet design using 55 years of tiltrotor experience and that of the team behind it.

Illustrating the point about teaming on the project, Garrison said that ‘Team Valor’ includes Lockheed Martin, which is “a significant investor who is bringing technologies from the Joint Strike Fighter (JSF) world.” He added that Spirit AeroSystems is bringing the strength of its experience in structures, which would help to “attack cost points.” The partner list also includes GE engines, GKN Aerospace, Moog, Astronics Advanced Electric Systems, Meggitt and Lord Corporation.

Showing the progress the company has made, a full-scale mock-up was displayed at this year’s American Army Aviation Association (Quad-A) Mission Solutions Summit during May in Nashville, Tenn. The company went to the trouble of setting it in the middle of a circle that Garrison explained was the circumference of a UH-60 Black Hawk’s rotor.

Garrison stated with confidence that he was looking forward to the down select in the summer and talked about his expectation for the aircraft’s development and performance. He said that the expectation was for the first flight to occur in 2017 and that the V-280 would easily achieve 280 knots, adding, “actually we will disappointed if it only goes 280 knots.”

With the U.S. Army’s benchmark for helicopter operating capability now set at 6,000 feet and 95 degrees F (known widely as 6K/95), Garrison said that whereas the V-22 was designed for 3K/95 – although the U.S. Marine Corps and U.S. Air Force have both operated their MV-22B/CV-22s in Afghanistan – the new Valor would be prepared for high/hot operations.

Talking about the investment into the JMR TD, Garrison revealed: “We invest around four dollars for every dollar the government invests.” He said that he understood that the Department of Defense (DoD) was in “difficult position regarding their budget,” but went on to say that he understood that the Science and Technology (S&T) dollars were being protected and that there was an understanding of the importance of JMR development to the future of Army Aviation.

“In JMR, industry’s investment is significantly greater than the government’s investment currently, so it is a great opportunity [for the DoD] to leverage the government’s investment dollars with industry. Everything within DoD is a concern, but all indications are that they are fighting to protect the S&T.”

But the V-280 is not just a smaller V-22, far from it. Says Garrison: “Much of the technology going into the V-280 is designed to attack cost and complexity. It is a more simple design than before – we have more modern tools today than we did when designing the Osprey. Survivability will be an important part of the aircraft.”

But just as the V-22 relies on the attributes of speed and range, so will the V-280. “Think of what that means in terms of force structure and deploy-ability around the globe.” He says it provides a strategic as well as tactical advantage.

One weak point of helicopter operations, particularly over a large area, is the requirement for Forward Aerial Refueling Points (FARPS), which help helicopters to operate away from their main base locations for long periods. However, those FARPS need to be constantly manned and resupplied with fuel, which actually is a significant draw on resources. As with the V-22, Garrison suggest, a V-280 would cut those back significantly.

‘Underdog’ Challenger

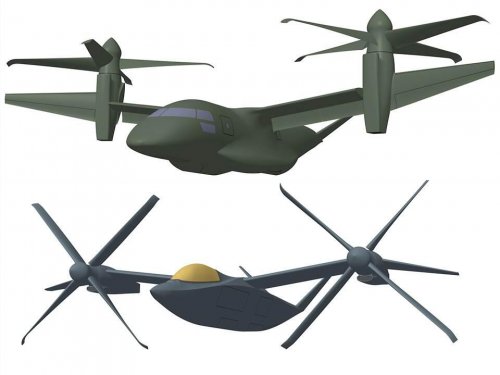

Troy Gaffey has not named the AVX Aircraft offering – he says that is up to the Army to do. However, if he were to attach a name to it he said, perhaps tongue-in-cheek, he would call it the Warhorse.

When questioned as to why this young pretender of a company with around 25 engineers could displace the might of Bell or the Boeing/Sikorsky duo, he points to the fact that nobody on the Army’s technical side has yet told him the company is too small to compete.

First, he points to the fact that within the AVX Aircraft team there is a wealth of experience and heritage gained working on the V-22 Osprey and the latest iterations of the H-1 family, the UH-1Y and the AH-1Z Super Cobra: “I was extensively involved as the technical director of the V-22; the guy designing our rotor system designed the V-22 rotor system; the guy who designed the V-22 main gear box is designing our drive system. The background is there and we are all familiar with working for a large company.”

As Garrison did, Gaffey points to the value of teaming with the right people: “We have put together a team who are doing some experimental and production work on the rotor system together with Eagle Aviation Technologies.”

He does not see the initial size of the company as a problem. “There is a big capability out there to build aircraft components. What we will most likely do is have a teaming arrangement with a company that can handle the assembly, integration and product support. We are talking to everybody, from helicopter manufacturers, fixed wing and military aerospace people.”

The AVX Aircraft proposal is also a clean-sheet design, but Gaffey believes that it is one that combines the right amount of innovations with balanced, practical and tried solutions. “We know about trade-offs: power and weight, speed and range, and of guarding against cost escalation.”

When discussing whether AVX will make the cut of “two from four” expected in the early summer, Gaffey said he believes that it will not be a black and white decision. The Army, he says, has given all of the contractors guidance on the process and to that, he believes, “the concept of down selecting two and the two others going away is probably not going to happen.”

According to Gaffey, there are five potential scenarios with the two extreme options at either end unlikely to happen. That is, all four going ahead, or two being selected while the other two have nothing further to do with JMR.

The vulnerability is the realization that AVX is the only one of the four competitors that has not flown its own aircraft. Bell’s tiltrotor pedigree speaks for itself; Boeing and Sikorsky have the X2 trials behind them and will fly the S-97 Raider (the aircraft that would have been presented to the Army for its now “on-hold” Armed Aerial Scout) by the end of the year; and Karem Aircraft founder Abe Karem designed and developed what eventually became Boeing’s A160 Hummingbird, the first helicopter (unmanned) to use a variable speed rotor system.

But Gaffey remains optimistic that AVX will be involved in the JMR program beyond the official decision point “because of the technology that we are bringing to the party – we have a lot of ideas that are new and different.”

The rotor blades on the AVX offering “are 20 percent lighter than you would predict; we have a unique design,” he states. “Similarly on the fuselage, we are working very hard to get airframe costs down so we are using technologies different to the others. One example is that we are trying to minimize the number of fasteners being used, and that is where cracks to the airframe can start. To illustrate this point, around half of the six million parts used to fabricate a Boeing 747-800 commercial airliner are fasteners.

He also considers the design and performance to be crucial. A new design needs to be better than the existing fleet of Apaches and Black Hawks. “First, it provides much better cabin arrangements for the troops; there will be more and they will be heavier with more equipment.”

Accordingly, the payload will be twice that of an existing Black Hawk, and it the aircraft will have double the combat radius. “Our dash speed will be 230 knots against the Black Hawk’s dash of 150 knots. The cruise speed will be 180 knots versus 130 knots. Gaffey also plans for the aircraft to self deploy in line with the Army’s requirement of reaching Hawaii from Travis Air Force base in California (a distance of around 2,300 miles). “Our aircraft can do that. We can put three ferry tanks into it, which will provide an additional 14,000 lbs of fuel to the internal tanks. We will also have a flight control system that allows it to fly unmanned, which has been a requirement for JMR. It takes 13 hours to get to Hawaii so we could potentially fly it unmanned all the way,” he said.

If not directly selected this summer, Gaffey believes there could still be roles for all the competitors in helping the Army to understand how a JMR platform will develop into what it will require in a FVL platform but, he reaffirms, he still feels good about plan A.

Neither is AVX Aircraft a one-program company. Gaffey revealed that AVX is talking to the U.S. Navy about its future helicopter requirement, although this is not a program of record yet. “The U.S. Navy is interested in replacing its SH-60 Sea Hawks. If you look at the JMR, it isn’t going to fit on a destroyer or a frigate and we have a smaller aircraft and an idea of how to fold one of these up that is rather interesting.” It has been considered that any JMR aircraft – which then turns into FVL medium – would be a platform that not only the Army, but the Navy and the Air Force would use. However, neither of the other services have committed to the JMR program, so the future for a one-platform fits all helicopter remains gray at best.

There is also an opportunity to deliver an unmanned platform to the Navy. “We have submitted an RFP with another company (BAE Systems) for MRM UAS concept for the Navy. That involves a long-range ISR (intelligence, surveillance and reconnaissance) mission where a smaller aircraft could speed out to the orbit point then loiter with long endurance.”

Back in 2010, AVX also responded to a U.S. Defense Advanced Research Projects Agency (DARPA) request that sought designs for a tactical fly/drive vehicle known as Transformer TX.

One of Gaffey’s colleagues, Frank King, senior vice president of business development, summed up the AVX approach to progressing its business. “We don’t bring with us either a legacy or burden of overhead that some of the bigger guys do. We applaud the Army in recognizing that innovation is not the birth rite of multinational corporations. We can bring innovation to the equation as well as utilize the capacity and skill that exists out there in the market. When it is time to gear up production facilities we have all the confidence in the world that we can partner with the folks who can deliver the scale of industry required.”