Saab, Dassault Upgrade Gripen, Rafale Fighters

JOHN D. MORROCCO,MICHAEL A. TAVERNAJULY 92001

Saab, Dassault Upgrade Gripen, Rafale Fighters

AERONAUTICAL ENGINEERING

JOHN D. MORROCCO

MICHAEL A. TAVERNA

LE BOURGET Saab and Dassault Aviation are moving ahead on longand short-term upgrades to their Gripen and Rafale fighters, as well as refining export versions.

Rather than a preplanned, mid-life update, Sweden plans a process of continually inserting new technologies into the multirole Gripen. The Swedish government is funding a number of technology efforts which will be added to Gripen once they mature, said Simon Carr, director of marketing for the Saab/BAE Systems Gripen joint venture for the export market. The Gripen Systems Development Plan includes enhanced electronic warfare systems, including laser and missile approach warning systems and towed decoys.

An infrared search-and-track system is already undergoing testing on a Swedish air force Viggen. Ericsson, meanwhile, is continuing work on an actively scannedarray radar which would provide increased detection ranges and sport a beyond-visual-range missile.

SWEDEN HAS COMMITTED to acquiring the MBDA Meteor missile, while the Denel R-Darter missile is to be integrated on the aircraft for the South African air force. South Africa, the first export customer for Gripen, has ordered 28 of the aircraft. In addition to BGT’s IRIS-T short-range missile which the Swedish air force will procure, the Rafael Python-4 and MBDA Asraam will also be available for export customers. Rafael’s Litening has been selected as the baseline targeting/navigation pod for export-version Gripens, with full clearance on the aircraft scheduled for 2004.

Another near-term problem with which Saab and BAE Systems are grappling is how to integrate NATO’s multifunction information distribution system Link 16 data link onto their export-version Gripens by 2004. Gripen already has its own, more sophisticated, tactical information data link system. It includes two data links, one for exchanging real-time combat infor-

mation between other Gripen aircraft operating in formation and another to exchange data with external sources. The easiest option would be to replace the Gripen system with the Link 16, Carr said.

“But we want to maintain the integrity of the intra-formation link. The challenge is to integrate the two together.”

More than 100 JAS 39 Gripens have been delivered to the Swedish air force out of a total order for 204. Three squadrons are now operational and a fourth is to be added soon. By 2004, the air force plans to have eight operational Gripen squadrons.

Batch 3 Gripens for the Swedish air force, which start to be delivered in two years’ time, will contain a number of features being developed for the export version. These include a night-vision-compatible cockpit, GPS integration, color displays and an air-to-air refueling capability.

This third batch of production aircraft will also include 14 two-seat Gripens for which the Swedish air force is eyeing a number of innovative missions. Maj. Gen. Mats Nilsson, inspector general of the Swedish air force, is looking to employ the two-seat D model to act as a commandand-control aircraft for strike packages or maritime operations. Suppression of enemy air defenses is another possible mission, as well as equipping the aircraft to act as a mini-airborne early warning platform or as the control ship for unmanned air vehicles.

For 2010 and beyond, Saab and the Swedish air force are looking at increased range and payload through the use of conformal fuel tanks or a fuselage plug. Carr said another option is upgraded engines.

He mentioned the General Electric F414, as well as a thrust-vectoring version of the EJ200.

Nilsson said other potential upgrades to the aircraft in 2010 include a wide-angle HUD, a binocular helmet-mounted display, a direct voice input system and an advanced missions support system.

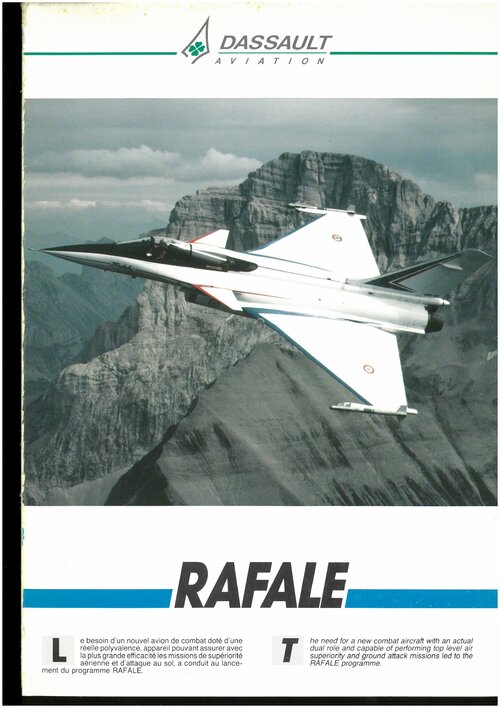

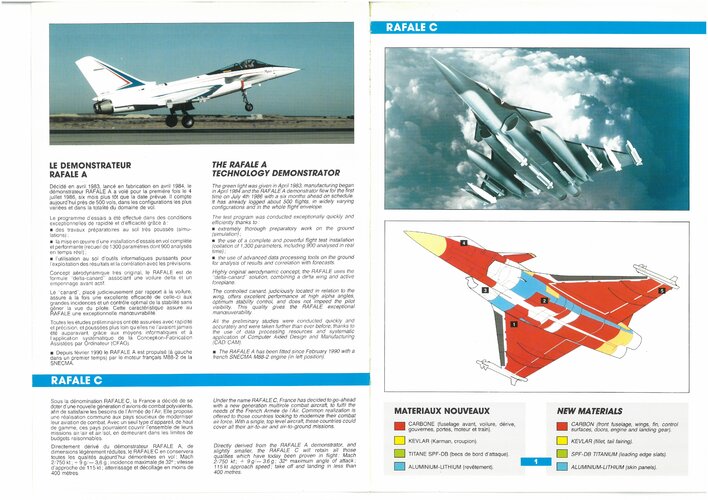

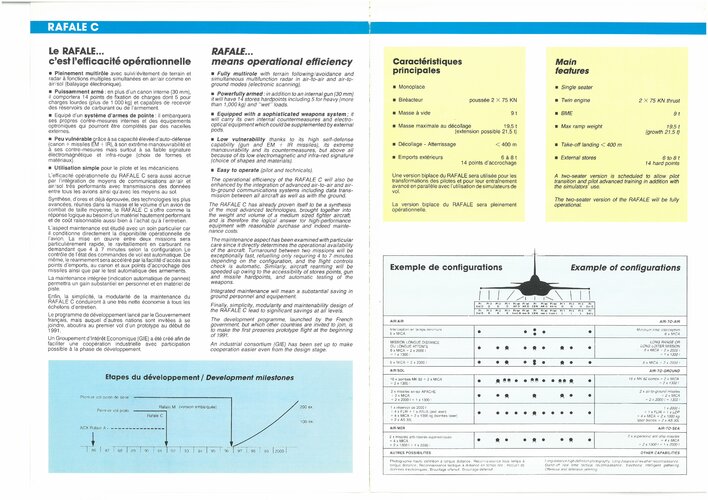

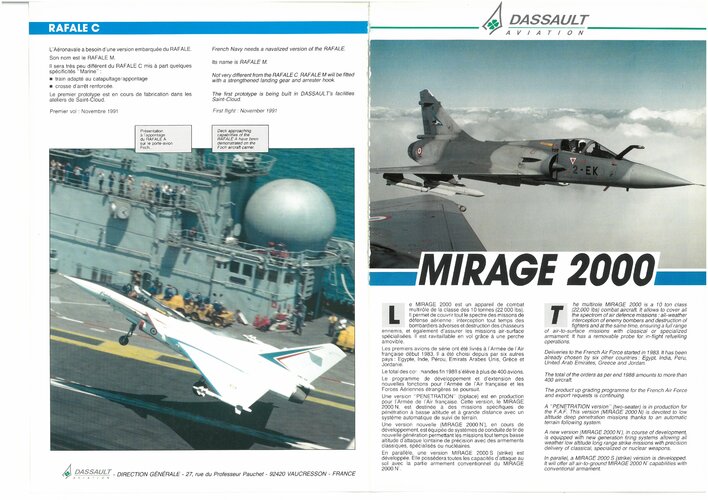

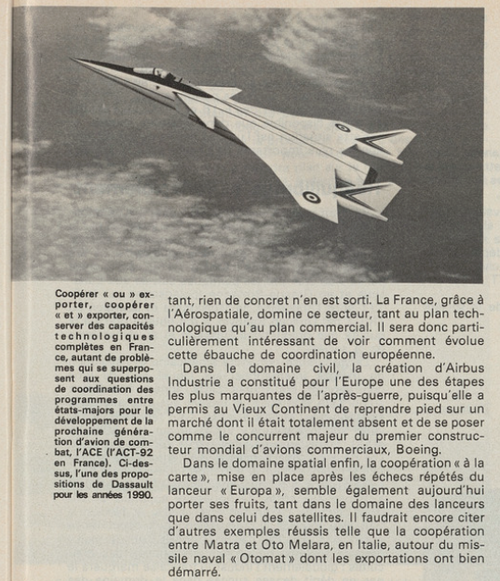

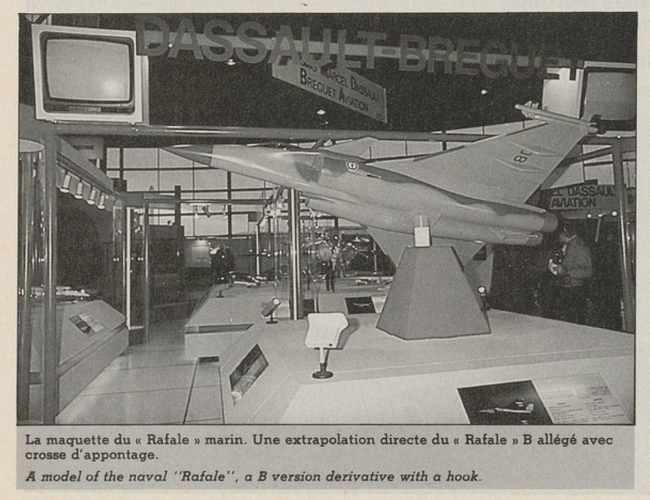

Meanwhile, Dassault Aviation recently launched an Mk 2 export version of the Rafale in cooperation with Thales and

Snecma. The latter two companies each have a 20% stake in Rafale International, the consortium created to market the aircraft to export customers. Dassault has a 60% share.

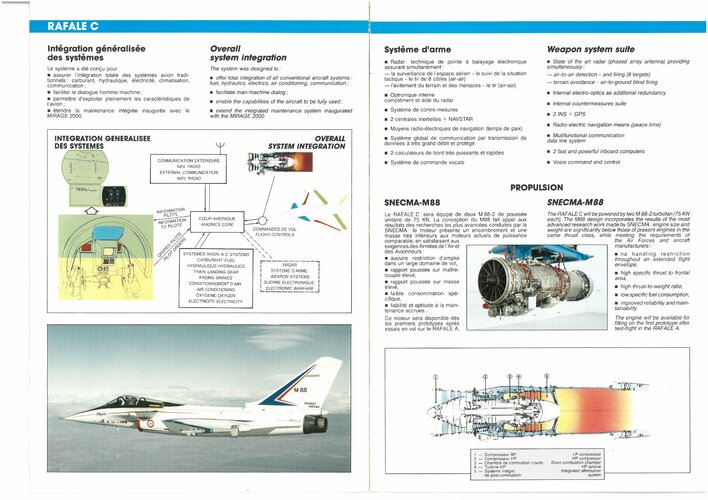

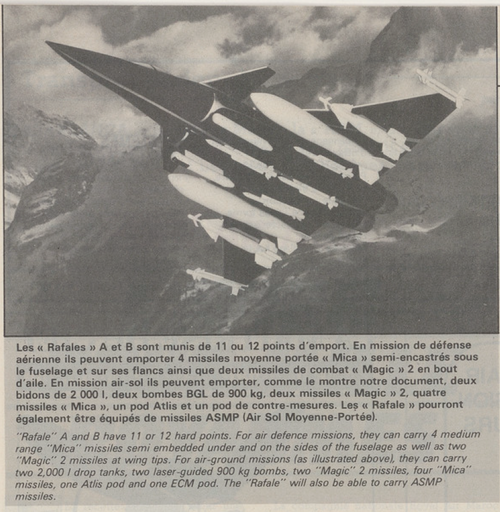

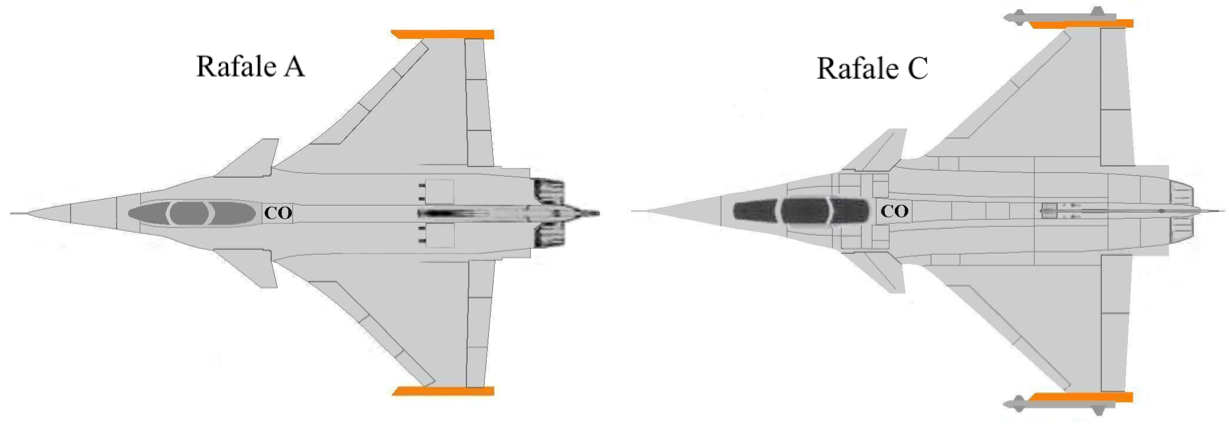

The Rafale Mk 2 is to be equipped with an upgraded Snecma M88-3 powerplant offering 20% more thrust than the basic model. Other features include F2 ground attack software, an active array antenna in place of the passive array currently employed on the Thales RBE2 fire control radar and Thales’ new Damocles laser designator pod.

THE EXPORT VERSION will also have conformal fuel tanks that will free up five external stores positions for additional weapons or electronic payloads. Flight testing of the conformal tanks, which will increase the aircraft’s range by 20-25%, began in March and have reached speeds of Mach 1.4, according to Dassault Chairman/CEO Charles Edelstenne. The flight qualification tests are expected to be completed by the end of the year.

Under a compromise with the French procurement agency, the contractor team will fully fund the 1.3-billion-euro ($1.1billion) upgrade package, which will be available in 2005. In return, the government agreed to pick up the full cost of development of the F2 ground attack software package.

Dassault expects the French government to exercise an option later this year for another 20 production Rafales, in addition to 28 already ordered under a fullscale production contract signed last year. Another 13 aircraft were purchased in an initial low-rate production agreement. France plans to acquire a total of 294 Rafales.

Six aircraft have already been delivered to the first operational unit, activated in May by the French navy. Three more are to be handed over before year-end.

THE COMPANY RECENTLY was awarded contracts for development of the F2 ground attack software package, to be introduced in 2005, and integration of the Scalp standoff weapon and Mica/IR beyond-visual-range missile. Development of the F3 software standard (encompassing reconnaissance, antisubmarine warfare, inflight refueling and nuclear strike capabilities) is to begin in early 2003.

Only 29% of Dassault revenues were generated by military aircraft sales last year, a share that is not likely to rise in the near term, considering the brisk pace of sales of the company’s business jets (AW&ST June 25, p. 28). Nevertheless, the medium-term goal is to stabilize at 60% civil/ 40% military, said Edelstenne. ©