"Shareholders assess new ATR turboprop business case"

January 23, 2013

Source:

http://www.hmgaerospace.com/news/show/4693

January 23, 2013

Source:

http://www.hmgaerospace.com/news/show/4693

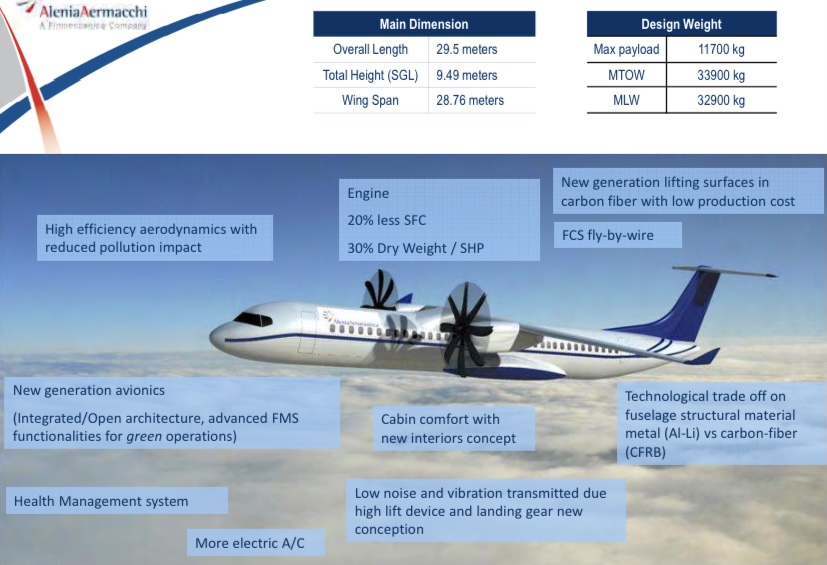

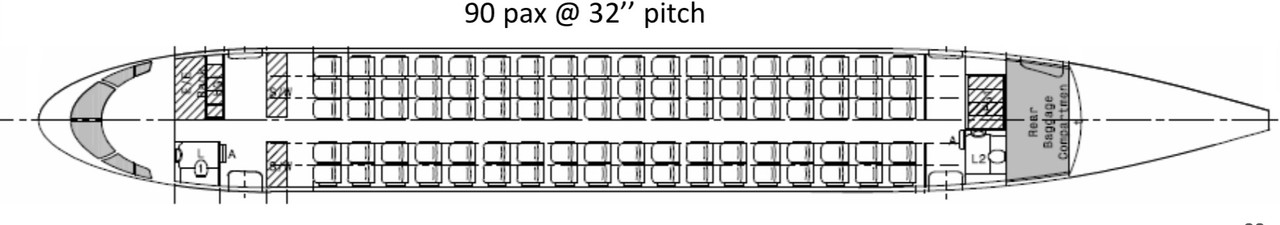

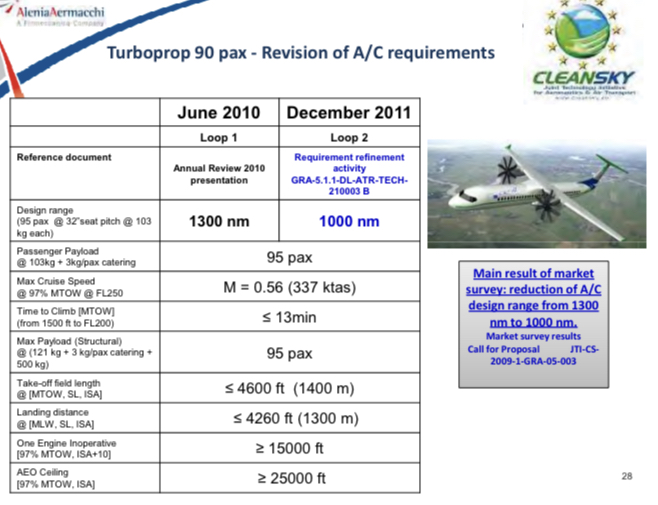

ATR says it has provided the business plan for a new generation turboprop with a target capacity of 90 seats to its parent companies, EADS and Finmeccanica, and is awaiting board approval to launch the programme.

Speaking at ATR’s annual results press conference, CEO Filippo Bagnato declared, “We’ve done what we said we would do. We checked the design with our customers and have received interesting suggestions to improve the product. We’ve also got feedback from our major suppliers, for example the potential performance of landing gear, avionics, and so on. We’ve given a bit more solidity to the project.

“Based on that solidity we have finished our first step business plan and delivered it to the shareholders. In 2013, they have a good base to discuss together,” he added.

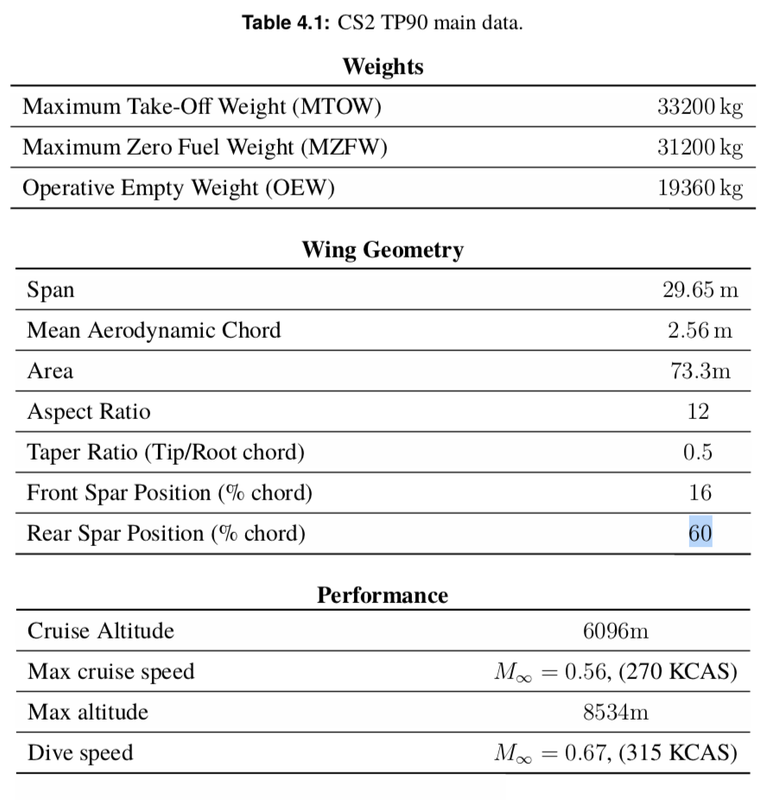

Bagnato said the 90-seater, “while maintaining same design concept as today’s ATR – “simple” – is from an overall standpoint is another aeroplane. The ATR 72 cannot be stretched. Once we studied an ATR 82, [a programme] which was left on paper. Due to length limitation, it was not possible without changes to both the wing and the engine.”

Bagnato added that he would not enter any agreement on engines without the OEM “being able to give me two brothers. The family concept is a key point. Major equipment must have a good level of commonality”.

Bagnato explained that a likely scenario will to have the 90-seater as a new aircraft, but having a version of the new engine fitted to the current models. New airframe designs for the 50- and 70-seaters are unlikely. “If I was designing an ATR 72 from scratch now, I would not do much different [with the airframe structure],” he stressed.

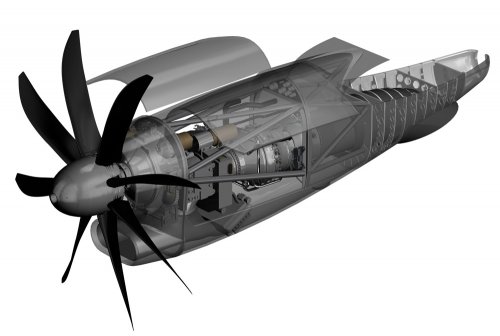

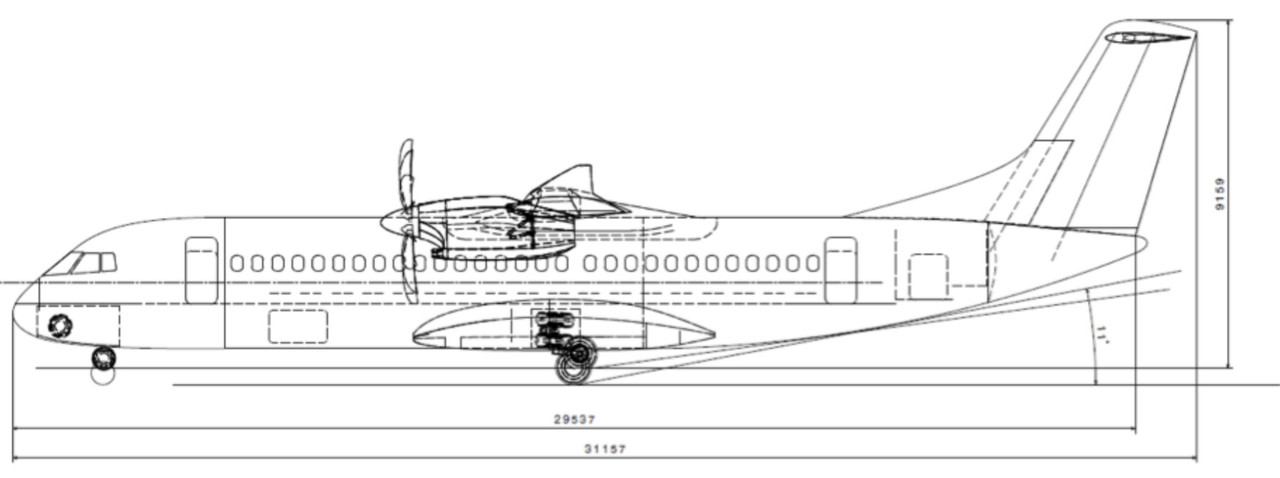

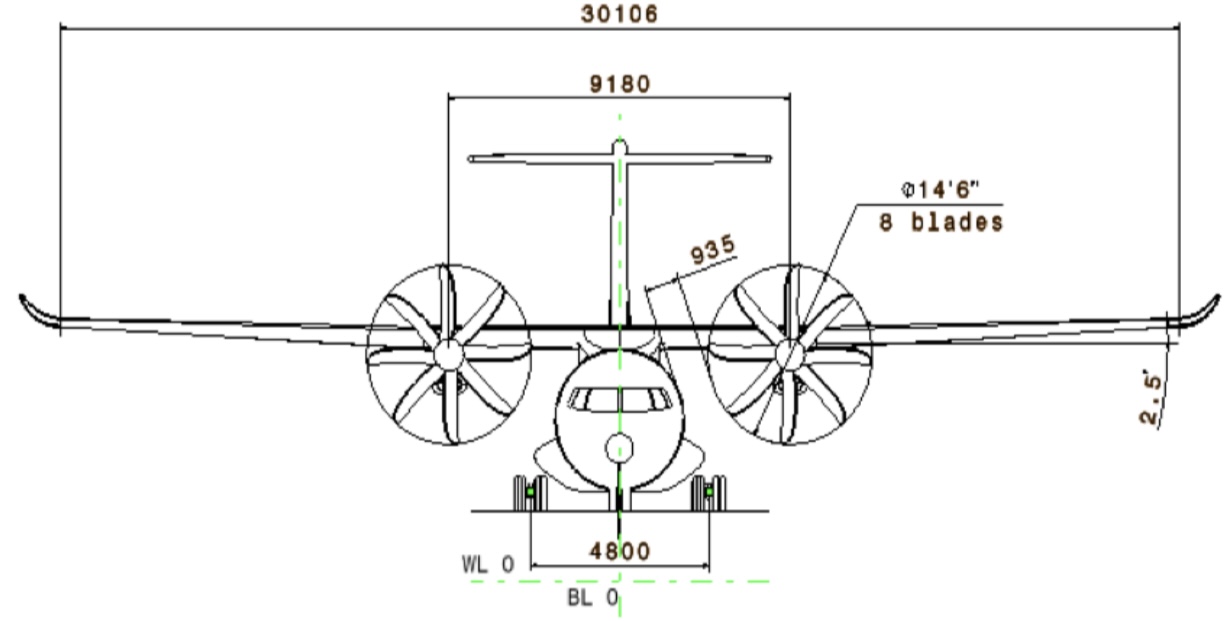

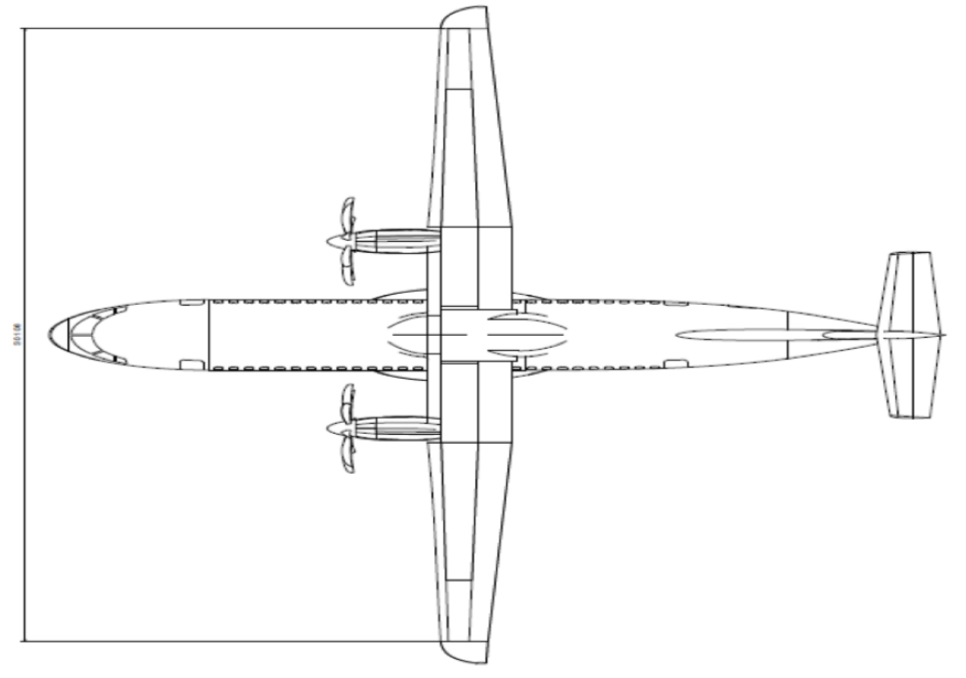

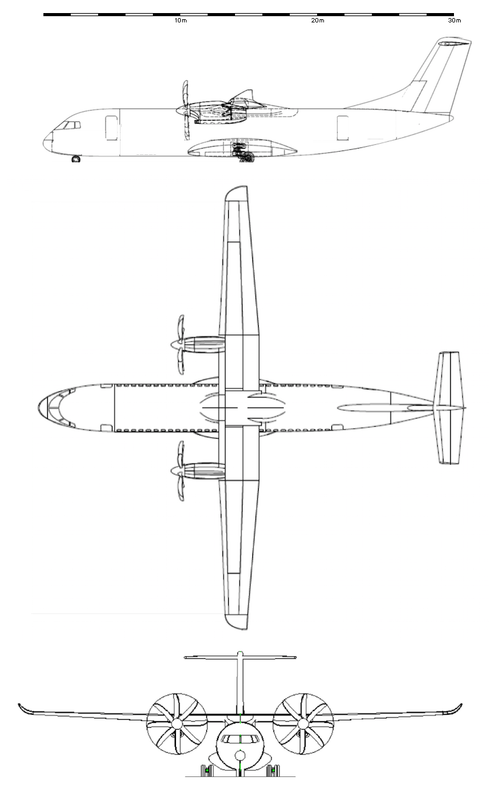

In his presentation, Bagnato showed an exterior design for the new 90-seat aircraft in silhouette, featuring winglets and eight-bladed propellers, which he confirmed as part of the design.

Of the systems required for the new aircraft, nothing has been selected. Those expressing interest among the engine manufacturers include Pratt & Whitney Canada and GE, with Safran the latest to join the potential supplier list.

Bagnato did not give any expected date for entry into service of the 90-seater but noted that bringing a new aircraft to market usually takes 50-60 months after the official programme launch.

As for the most likely market for the aircraft, the CEO indicated that the current largest market, Asia-Pacific, would continue to lead the way. “In Indonesia, Wings Air is definitely interested. It has a population of about 350 million to serve across thousands of islands.”